During this trading period our primary focus was on preserving capital and minimizing potential losses, rather than chasing high returns. This approach has allowed us to maintain a steady performance, even in volatile market conditions.

Our total PNL stands at 24.54 for March second half, indicating that we have managed to generate profits while keeping risks at bay. The period gain of 0.78% may seem modest, but it is a testament to our commitment to steady and sustainable growth.

Our win ratio of 96.48% further underscores our risk-averse strategy. This high win ratio indicates that the vast majority of our trades were profitable, a result of careful selection and diligent risk management.

We executed a total of 910 trades, each one carefully analyzed and vetted for potential risks. Our top gainer pair was AGIUSDT, but our success was not reliant on any single pair. Instead, we diversified our trades across multiple pairs to spread the risk and increase the chances of steady returns.

In conclusion, our trading strategy for this period was characterized by careful risk management and a focus on steady, sustainable returns. We believe that this approach, while not flashy, is the key to long-term success in trading.

Results sheet:

https://docs.google.com/spreadsheets/d/e/2PACX-1vRY-I8N19q2Jrpsnm4yHU8-OQbVUaZ9QmRy32thUnOkQh3GGEQYooFLgfPV_aM9E-jM_PD9TPIIOeYc/pubhtml

🔥 Want to let our service work with your money and make more?

📩 DM @ECRYPTORRRRRRRRRRRRR (on Telegram)

And find out more!

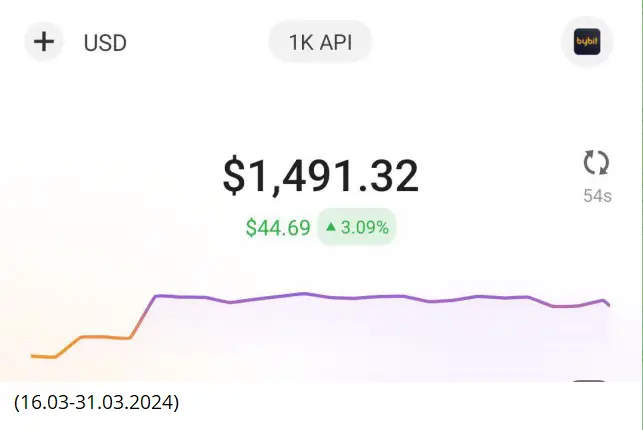

Total PNL for MARCH – 491.32$ (49,3%)